HARROW (HROW)·Q4 2025 Earnings Summary

Harrow Reaffirms $270-$280M Guidance, Doubles Down on Sales Force Expansion

February 2, 2026 · by Fintool AI Agent

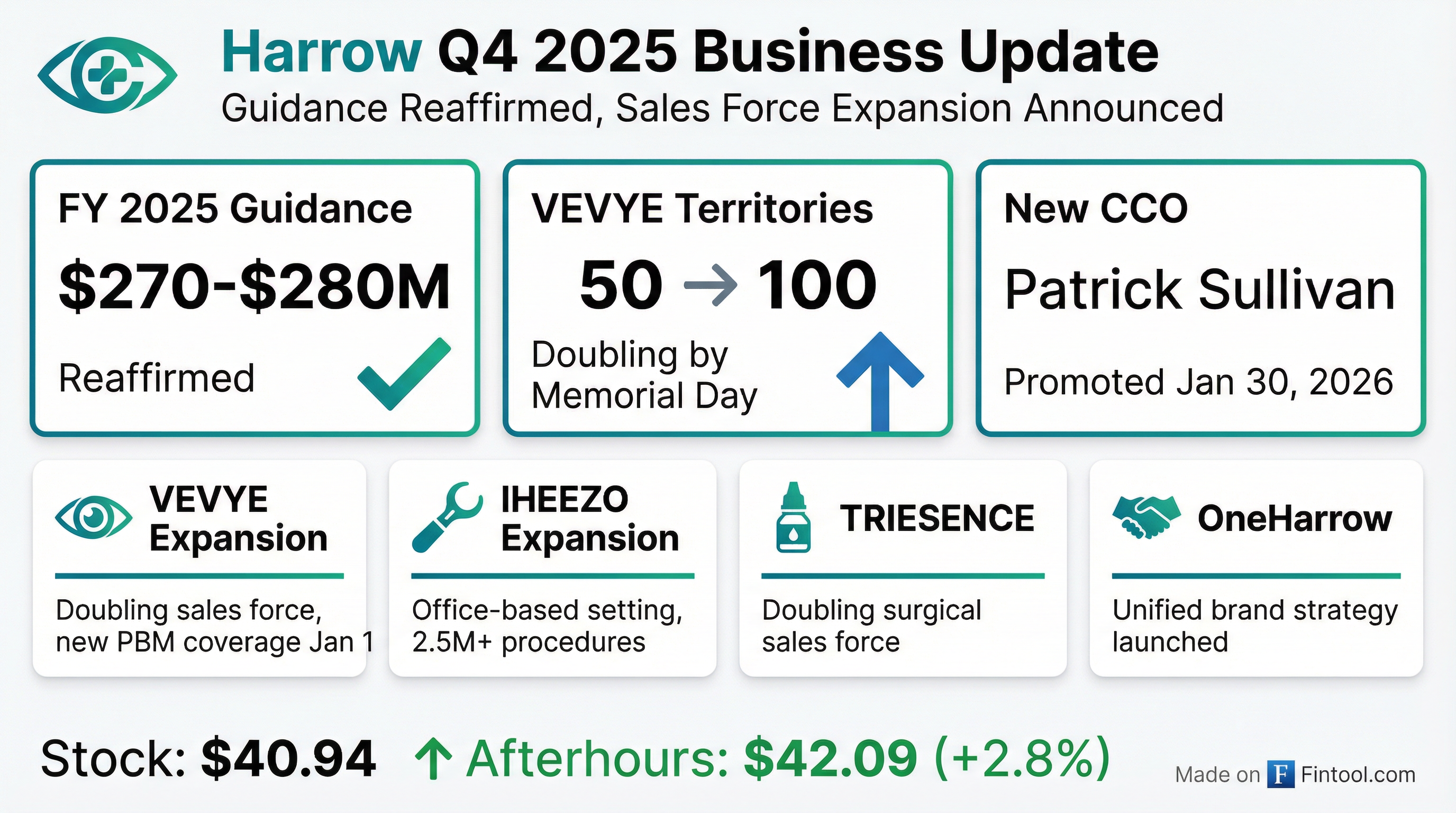

Harrow (NASDAQ: HROW) issued a business update today reaffirming full-year 2025 revenue guidance of $270-$280 million and announcing significant commercial expansion plans. This is not the Q4 2025 earnings release—full year 2025 financial results will be announced in early March. The stock closed at $40.94 but rose to $42.09 (+2.8%) in after-hours trading following the announcement.

What Did Harrow Announce?

This 8-K filing contains several key developments:

How Did the Stock React?

HROW shares have been volatile over the past year, ranging from a 52-week low of $20.85 to a high of $54.85. The stock closed at $40.94 on the day of the announcement but rose 2.8% in after-hours trading to $42.09, suggesting investors view the business update positively.

What Changed From Last Quarter?

In Q3 2025, Harrow delivered $71.6 million in revenue (+45% YoY, +12% sequential) and updated FY 2025 guidance to $270-$280 million. CEO Mark Baum highlighted the major coverage win with the largest U.S. Pharmacy Benefit Manager for VEVYE, effective January 1, 2026.

Key Q3 2025 Performance:

Today's update confirms the commercial momentum is continuing, with management now committing to double the VEVYE sales force by Memorial Day.

What Are the Key Growth Catalysts?

VEVYE Sales Force Expansion

Harrow is doubling VEVYE territories from approximately 50 to 100 by Memorial Day 2026. This investment is driven by:

- Major PBM coverage win: The largest U.S. pharmacy benefit manager began covering VEVYE as a preferred product on January 1, 2026

- Expected net pricing stabilization: Management expects the ratio of covered vs. cash-pay prescriptions to flip, improving ASP

- Market share gains: VEVYE captured 10.5% of the total dry eye market by Q3 2025, doubling share in two quarters

IHEEZO Office-Based Expansion

Harrow is expanding IHEEZO beyond retina practices to the broader office-based ophthalmic procedures market, estimated at 2.5+ million annual use cases. Target procedures include:

- Non-retina intravitreal and subconjunctival injections

- YAG/laser and glaucoma laser procedures

- Foreign body removals

- Selected ocular surface and eyelid procedures

TRIESENCE Growth

The surgical sales force supporting TRIESENCE is being doubled, driven by positive clinical feedback and improving demand metrics. TRIESENCE unit demand grew 67% sequentially in Q3 2025, with 53% of orders from new customers.

What Did Management Say?

"Our team delivered another year of strong growth in 2025, supported by positive demand trends across our key revenue-driving products... As we begin what we believe will be another record-setting year of growth, after many years operating under two separate commercial organizations (ImprimisRx and Harrow), the OneHarrow initiative will provide greater focus, tighter alignment, and a unified effort."

— Mark L. Baum, Chairman & CEO

On Patrick Sullivan's promotion:

"I also want to congratulate Pat Sullivan on his promotion to Chief Commercial Officer. Over the past 5 months, he has stepped in and has improved the structure and focus of our commercial organization... I especially appreciate that Pat enthusiastically agreed to his new equity incentives as performance stock units that vest upon achieving our company-wide revenue goal of $230 million in branded revenue in a calendar quarter."

— Mark L. Baum, Chairman & CEO

CCO Compensation Details

Patrick Sullivan's promotion to Chief Commercial Officer includes:

The $230 million quarterly revenue threshold for the performance RSUs represents a significant step-up from current run-rate (~$70-80M/quarter), aligning executive incentives with aggressive growth targets.

What Are the Risks?

ImprimisRx California Exit

ImprimisRx settled with the California Board of Pharmacy for approximately $157,000 and voluntarily exited California effective February 1, 2026. Management characterized this as "not financially material" and cited California's "increasingly unpredictable, costly, and punitive regulatory environment."

Execution Risk on Sales Force Expansion

Doubling the VEVYE and TRIESENCE sales forces by Memorial Day represents significant operational execution risk. Management will need to recruit, train, and deploy approximately 50 new sales territories in ~4 months.

Q1 Seasonality

CFO Andrew Boll noted in Q3 that Q1 typically sees a seasonal decline from Q4, consistent with historical patterns. This is driven by end-of-year stocking activity in Q4 and deductible resets in Q1.

Historical Beat/Miss Trend

Based on available estimates data, Harrow's recent quarterly performance shows improving fundamentals:

*Values retrieved from S&P Global

Note: Q2 2025 revenue miss was partially due to timing of TRIESENCE and rare/specialty portfolio underperformance, which management addressed with new leadership and strategies.

Pipeline Update

MELT-300: All ancillary studies required for NDA submission have been initiated. Harrow remains on track to submit the NDA in H1 2027. This non-opioid procedural sedation candidate has potential applications beyond ophthalmology in dental, GI, and MRI procedures.

Upcoming Launches:

- BioViz (biosimilar): Expected mid-2026

- OpioViz: Expected mid-2027

- Biclovi: In pipeline

- MELT-300: NDA filing H1 2027

Looking Ahead

Harrow will release full-year 2025 financial results in early March 2026. Key metrics to watch:

- FY 2025 Revenue: Will it land within the $270-$280M guidance range?

- Q4 VEVYE Performance: Did October's "all-time high" in prescriptions translate to record revenue?

- 2026 Guidance: Management expects "another record-setting year"—what specific targets will they provide?

- PBM Impact: How much did the January 1 coverage wins improve the covered vs. cash-pay prescription mix?

The business update suggests management remains confident in execution, backed by concrete investments in commercial infrastructure. The alignment of executive compensation with revenue milestones ($230M quarterly branded revenue) signals management's commitment to aggressive growth targets.

Harrow (NASDAQ: HROW) is a leading provider of ophthalmic disease management solutions in North America, offering products for conditions including dry eye disease, age-related macular degeneration, cataracts, and glaucoma.

Related Links: